All about Estate Planning Attorney

All about Estate Planning Attorney

Blog Article

Getting The Estate Planning Attorney To Work

Table of ContentsEstate Planning Attorney Things To Know Before You BuyThe Greatest Guide To Estate Planning AttorneyThe smart Trick of Estate Planning Attorney That Nobody is Talking About3 Simple Techniques For Estate Planning Attorney

Estate preparation is an activity plan you can make use of to establish what takes place to your properties and obligations while you're alive and after you die. A will, on the other hand, is a legal file that describes exactly how possessions are dispersed, that takes treatment of kids and pets, and any various other wishes after you pass away.

The executor likewise needs to pay off any type of tax obligations and debt owed by the deceased from the estate. Financial institutions typically have a limited amount of time from the day they were notified of the testator's fatality to make insurance claims against the estate for cash owed to them. Claims that are rejected by the executor can be brought to justice where a probate judge will have the last word regarding whether or not the claim stands.

Getting My Estate Planning Attorney To Work

After the inventory of the estate has actually been taken, the value of properties computed, and tax obligations and debt repaid, the administrator will after that seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of inheritance tax that are pending will certainly come due within nine months of the date of death.

Each specific locations their assets in the count on and names somebody various other than their spouse as the recipient., to sustain grandchildrens' Source education.

A Biased View of Estate Planning Attorney

Estate organizers can deal with the contributor in order to reduce taxable earnings as a result of those payments or create techniques that make the most of the effect of those contributions. This is one more technique that can be utilized to restrict fatality taxes. It includes an individual locking in the present worth, and thus tax obligation liability, of their home, while associating the value of future growth of that capital to another person. This method involves freezing the worth of a property at its value on the day of transfer. Appropriately, the amount of potential funding gain at death is also frozen, permitting the estate planner to approximate their possible tax liability upon death and better strategy for the payment of revenue taxes.

If sufficient insurance earnings are readily available and the plans are effectively structured, any earnings tax on the considered dispositions of possessions complying with the fatality of a person can be paid without turning to the sale of assets. Profits from life insurance coverage that are obtained by the beneficiaries upon the death of the guaranteed are normally income tax-free.

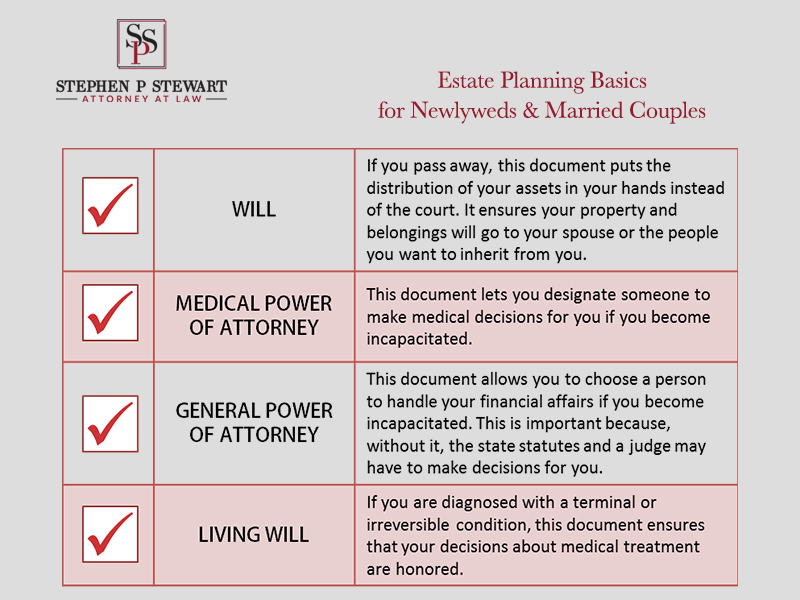

There are certain records you'll require as part of the estate preparation process. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is only for high-net-worth individuals. Estate intending makes it less complicated for individuals to determine their dreams prior to and after they pass away.

All About Estate Planning Attorney

You should start preparing for your estate as quickly as you have any kind of measurable asset base. It's a continuous procedure: as life webpage advances, your estate plan should shift to match your situations, in accordance with your new goals. And keep at it. Refraining from doing your estate preparation can trigger undue economic worries to enjoyed ones.

Estate preparation is often assumed of as a device for the wealthy. Yet that isn't the situation. It can be a useful way for you to manage your properties and liabilities prior to and after you pass away. Estate planning is additionally an excellent means for you to outline prepare for the care of your small kids and animals and to outline your here are the findings dreams for your funeral service and preferred charities.

Applications must be. Qualified applicants who pass the exam will be officially certified in August. If you're qualified to rest for the test from a previous application, you may file the brief application. According to the regulations, no qualification shall last for a period much longer than 5 years. Learn when your recertification application is due.

Report this page